Europe’s Procurement Pivot: What ‘Buy European’ and the End of Fossil-Fuel Tax Breaks Mean for Mobility Buyers

The European mobility landscape is undergoing a quiet but powerful transformation, one driven not just by technology but by procurement policy. Two recent shifts are reshaping how fleets are sourced and funded: the European Commission’s push for a ‘Buy European’ industrial strategy and new rules to phase out corporate tax breaks for fossil-fuel vehicles.

For procurement professionals in the mobility industry, this is more than a headline. It’s a signal: Europe is doubling down on strategic autonomy and climate-aligned procurement.

‘Buy European’ Is More Than Protectionism…. it’s Resilience

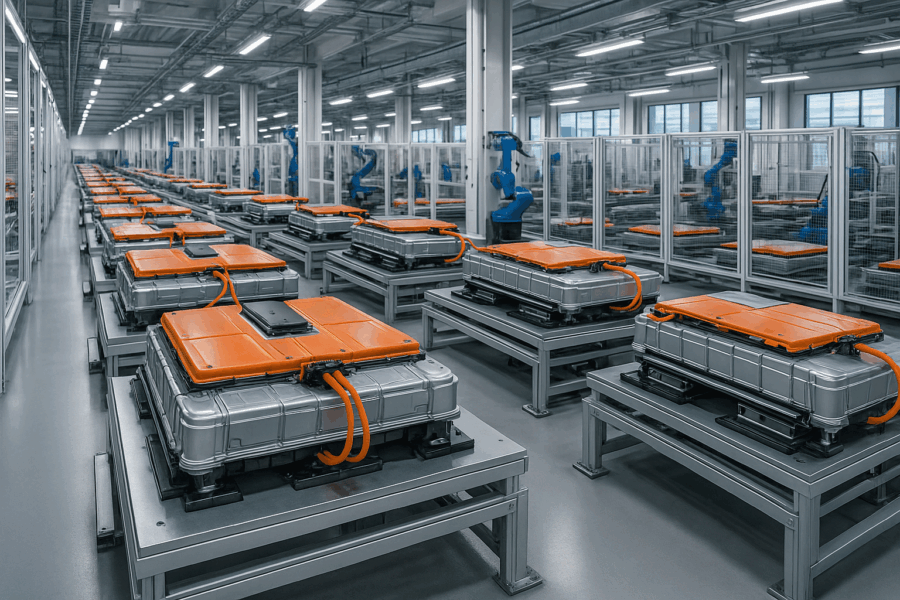

In light of growing geopolitical uncertainty, supply chain fragility, and competitive subsidies from global players (notably the U.S. Inflation Reduction Act), the EU is positioning its own version of industrial self-defence. Under the “Buy European” strategy, public and corporate buyers are being steered toward EU-sourced technologies, components and vehicles, particularly in critical sectors like electric mobility and batteries.

Procurement leaders should expect tighter origin rules, higher ESG scrutiny and greater emphasis on supplier transparency.

This shift isn’t about closing off from the world, it’s about future-proofing European mobility ecosystems. Sourcing from within the bloc may soon become not just preferable, but necessary to stay compliant and competitive.

The End of Fossil-Fuel Tax Breaks: A Wake-Up Call for Fleet Managers

As of mid-2025, several EU member states led by France, the Netherlands, and Belgium are moving to phase out or eliminate corporate tax incentives for fossil-fuel company cars. These tax breaks have long shielded internal combustion engine (ICE) vehicles from their true total cost of ownership.

The implications are profound:

- EVs become more competitive in TCO without relying on subsidies.

- Green mobility procurement becomes a financial imperative, not just a climate commitment.

- Procurement criteria will need to evolve to prioritise long-term operational value over short-term purchase cost.

What Procurement Teams Must Do Now

- Audit Your Fleet Contracts: Identify exposure to ICE vehicle leases or fuel-based incentives that may soon expire.

- Prequalify EU Suppliers: Begin verifying origin, sustainability certifications, and supply resilience of current and potential vendors.

- Build Policy-Responsive Specs: Update your RFQs and RFPs to align with evolving environmental, social, and governance (ESG) targets.

- Engage Finance Early: Tax structures are changing; fleet sourcing decisions must now be fully coordinated with financial planning teams.

Conclusion: Procurement as Strategic Policy

Europe’s shift toward “Buy European” and the removal of fossil-fuel tax breaks marks a clear realignment of market signals. In this new phase, procurement is no longer a back-office function it’s a front-line actor in industrial strategy and climate action.

Organisations that respond quickly will gain more than compliance. They will gain resilience, local supplier alignment and future-ready fleets.